2018 Software IPO Analysis — End of the Year Update

In May I published a detailed analysis of the software IPO market, which can be found here…

In May I published a detailed analysis of the software IPO market, which can be found here: https://medium.com/@Alexoppenheimer/software-ipo-analysis-2095bf2b7337

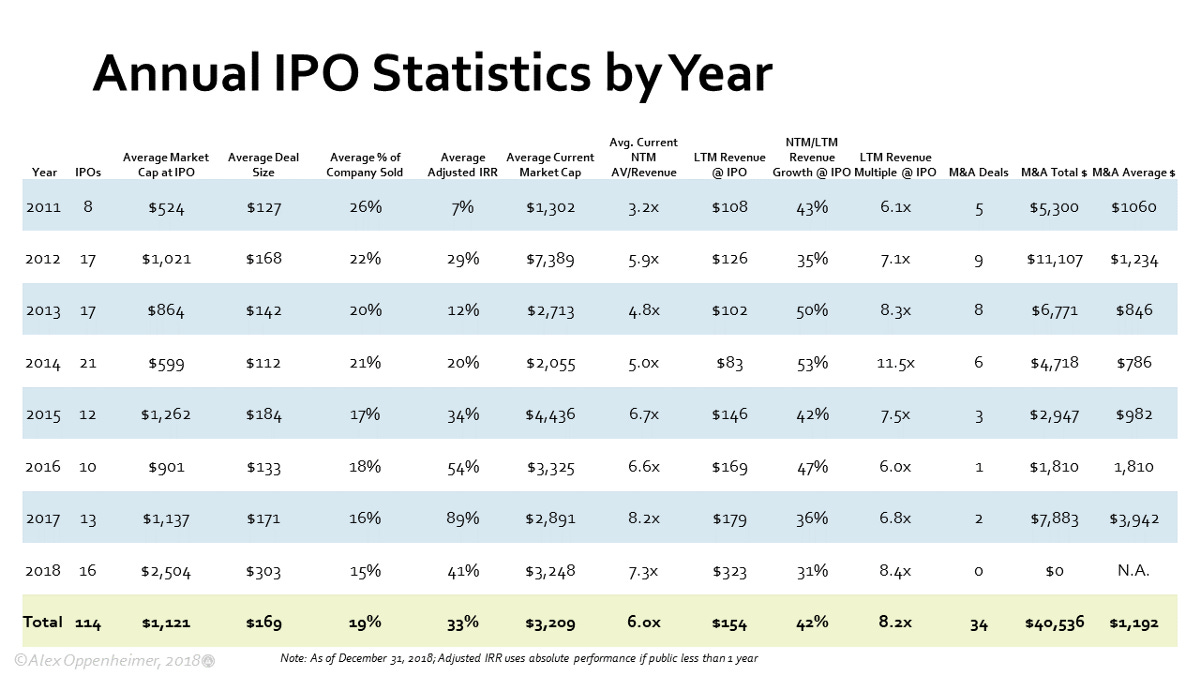

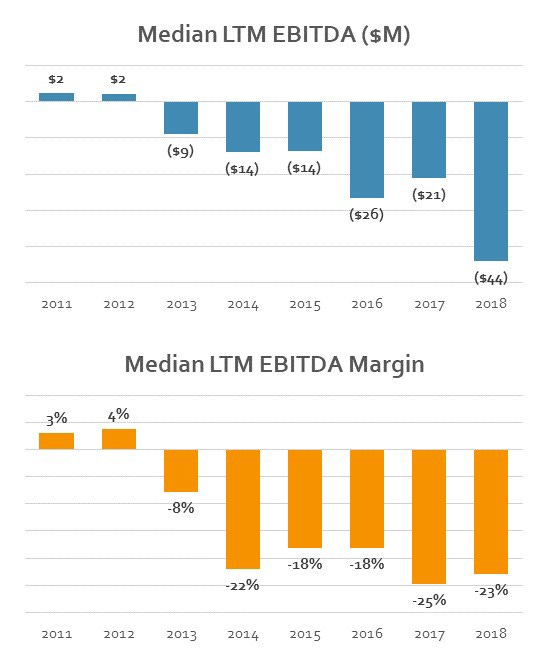

I updated the metrics for current prices, new IPOs and new M&A deals and have included the updated analysis below. 2018 was a very strong year for IPOs and M&A despite a correction in public markets at the end of the year.

There were 16 IPOs in 2018 in total, making it the most active year since 2014 and the average market caps and dollars raised continued to stay very high.

Hopefully we see some more IPOs in 2019 (though M&A has already been strong, especially by financial sponsors) and I’ll publish another updated analysis.

5 new M&A deals. Performance has stayed very strong. The additional 10 2018 IPOs brought the averages down, but all size metrics are still meaningfully above all the other years.

I projected 18 IPOs by the end of 2018 in my last post and we ended up at 16 — not too far short. (Note I also included one additional IPO from 2017 that I had missed in my original post).

The big IPOs early in 2018 (Drobox, DocuSign, Pivotal) skewed the early data, but the additional 10 IPOs brought the averages closer to normal.

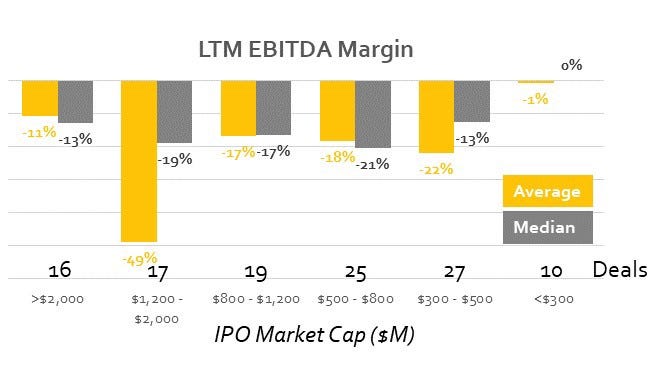

The additional large IPOs brought down the averages meaningfully. 4 Additional IPOs in the $1-$2Bn bucket brought the average down from -25% to -49%.

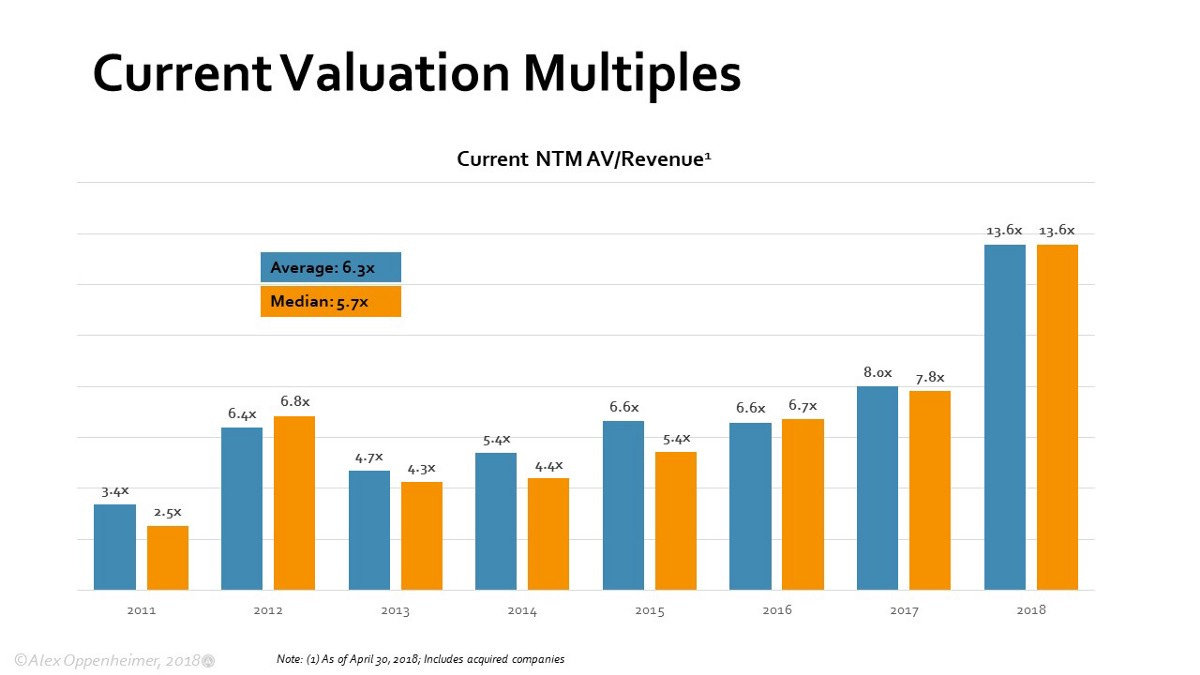

Sizes definitely decreased throughout the rest of 2018, but mutliples stayed strong.

Domo and Pluralsight sold an unusually high % of the company at IPO, but the remaining IPOs were low %s and strong at pricing. Solarwinds was a sponsor-backed IPO, hence the unusually low %.

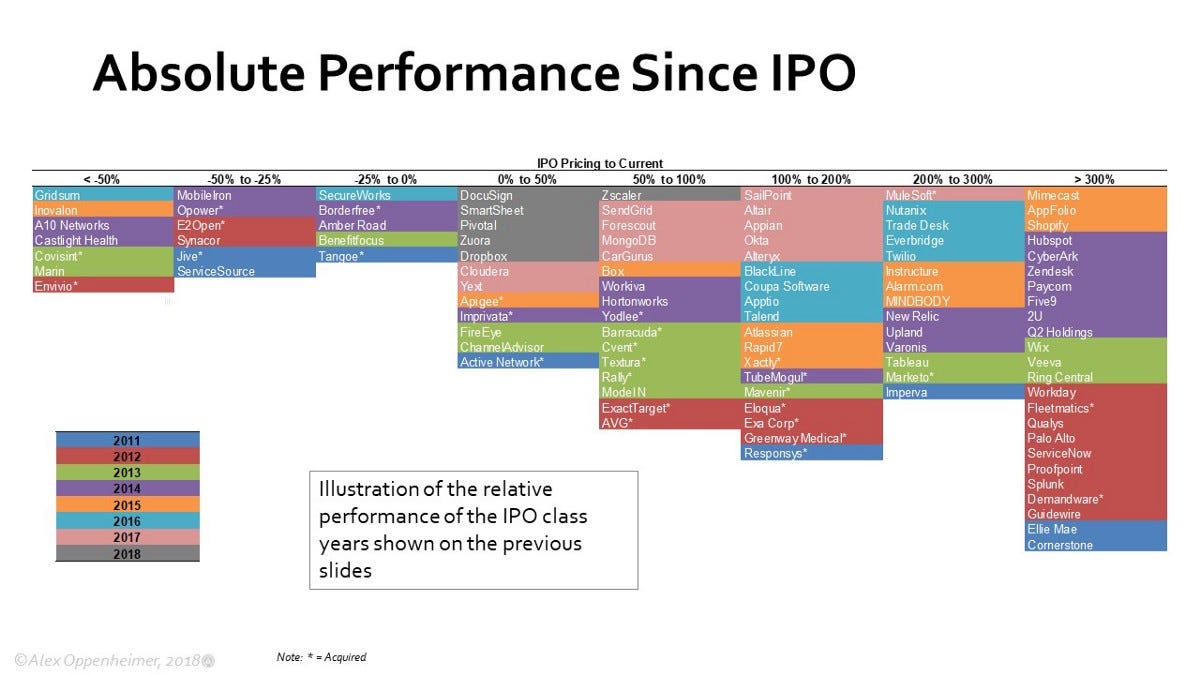

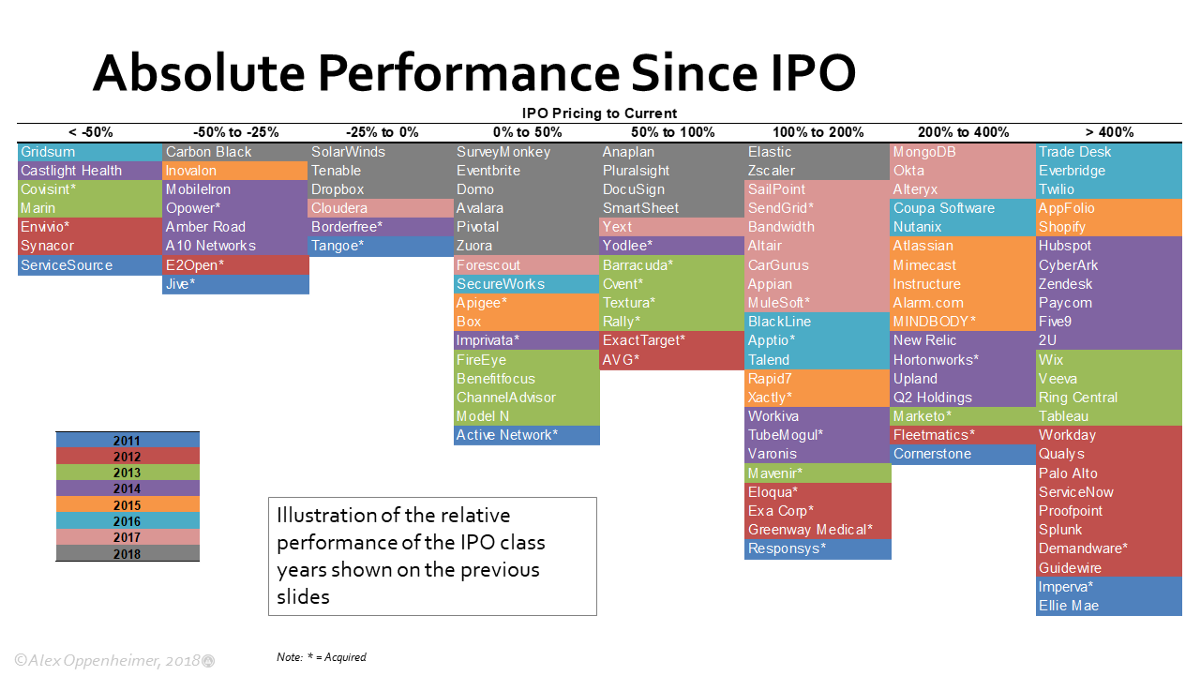

Most IPOs were still well above pricing at the end of 2018.

As of April 30, 2018:

As of December 31, 2018:

Overall performance was even stronger through the end of 2018.

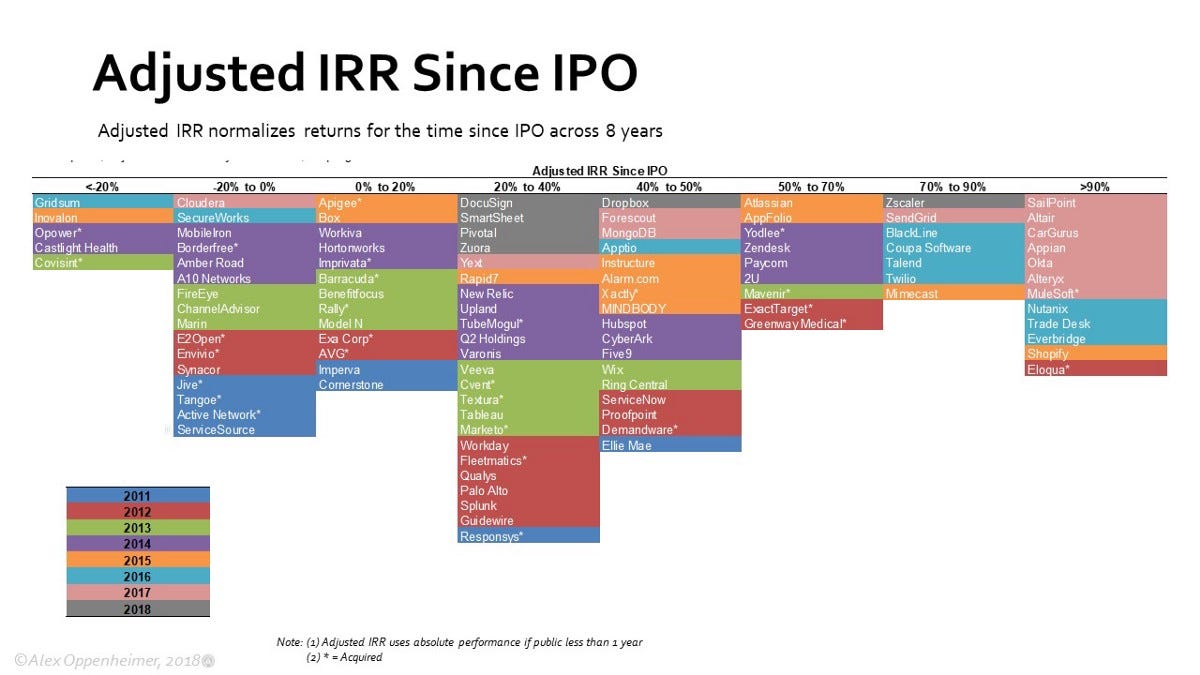

As of April 30, 2018:

As of December 31, 2018:

As of April 30, 2018:

As of December 31, 2018:

Average multiples came way down for the 2018 class throughout the year due to the additional deals and tougher market environment.

14 of the 16 IPOs that priced in 2018 were above $1Bn market cap at pricing and 7 above $2Bn.

2018 Ended as a big year for M&A with a number of mega acquisitions and PE buyouts.