There’s no secret that valuations for nascent technology companies are more art than science. It’s extremely difficult to nail the valuation on a company with so many extreme variables, and it is made even tougher by the fact that there is no objective way to validate those valuations (even at exit!).

That being said, just because it’s hard or inexact, does not mean that we are completely absolved from any obligation to spend some time on the science that underpins this art. To do this, we must go all the way back to the basics of company valuation: the DCF.

The danger of any of the interim or proxy valuation valuation methods (i.e. comparable multiples of any sort) is that we are compounding inexactitude, leading to results that are both inaccurate and imprecise. Bringing things all the way back to the fundamentals simplifies the conversation and gives us a clearer view of how valuation works in these nebulous situations.

In an effort to bring accuracy back into the valuation equation, I have isolated the key variables that drive value in a DCF analysis and built a model to simply and clearly quantify the impact of changing those variables on the value of a business.

The key variables in a DCF are:

Near-term growth (5-15 years)

Long-term growth (beyond the growth period) - g

Short and long-term cash flow margin

Discount rate - representative of risk in the business - r

As some background, the Discounted Cash Flow (DCF) Valuation analysis works by first projecting cash flows for the business for between 5-15 years, then calculating the net present value of those cash flows using a discount rate (r). There is then a terminal value that represents the value of the cash flows that will come after the initial 5-15 year growth period. The terminal value calculation is based on financial math and uses the last year’s cash flow, the same discount rate and includes a long-term growth rate (g) which represents how the business will continue to grow once it reaches steady state. Usually this relates to GDP and sector growth expectations, but more generally represents steady state long-term growth for that business. Note that the growth period (5-15) years also has an impact on the DCF valuation model. Ideally we would know how long it will take for a company to get to a steady state growth rate, but this is very hard to nail because it depends on the other variables. In our example, we’ll use 10 years. For more on the DCF Analysis see a great overview here.

Note that you don’t need to be an expert in these calculations to understand these concepts and how changes in the key variables impact the value of a business. Hence directional valuation - we are less concerned in this exercise about nailing the exact valuation and more interested in how changes in key business variables impact a business’s value. The DCF model is a reliable mechanism to bring these variables together in just the right way to illustrate their relative impact on valuation.

Understanding the Variables

Now let’s map some of the key things we do know about startups even from an early stage to these variables and attempt to directionally understand their impact on valuation using the DCF model. We’ll see that our instincts around these variables are often correct, though our understanding of their quantitative impact is much more challenging - the model is here to help us.

Near-term growth

How fast is the business growing right now?

How fast can it grow based on supply needs, customer adoption, regulation, etc.?

What do we know about the pipeline and broader customer base and their purchasing behavior and price sensitivity?

Are there elements to the product itself (expansion opportunities, virality, etc.) that might allow this business to grow incredibly fast?

(Note that I have modeled this is a initial revenue growth rate and then percentage decelerating factor. The best way to play with these two variables and look at the bar chart - is that trajectory realistic?)

Long-term growth

Once at steady state, how fast can the company continue to grow in perpetuity?

How big of a market is this company operating in and how tough is the competition in that market?

Is there micro economic pricing pressure or macro economic limitations to growth?

(While in most DCFs, this gets set at a number close to GDP growth, I think it’s safe to assume a meaningfully higher long-term growth rate for software businesses selling into massive markets. See companies like Microsoft, Oracle, Salesforce, etc. who continue to grow at 10%+ at massive scale, albeit inorganically in many cases.)

Short and long-term cash flow margin

What are the near-term cash needs of the business? Will it require $1Bn of primary equity financing to get to cash flow breakeven?

Long-term cash flow margins are where the unit economics come into play, and this is exactly what investors are trying to understand by looking at the underlying unit economics of even the earliest stage businesses. It is best to look at scaled businesses with a similar product, customer base and go-to-market motion to understand what long-term margins can look like.

Software is good - really good: Microsoft: 32%, Oracle: 23%, salesforce: 20%, Adobe: 41%, Ansys: 29%.

Subscription media is not as good: Spotify: 1%, Netflix: 3%.

Ecommerce and retail is not so good: Amazon: 2%, Walmart: 3%, Target 2%.

You might be saying that the scale and speed of subscription media or ecommerce is better than that of enterprise software, so the lower margin is OK - that’s true, but for this variable, we are focused solely on the cash flow margin and account for the other factors in other variables.

Discount rate

This is risk: operating risk, team risk, industry risk, technology risk, financing risk, and every other type of risk you can think of. The higher the number, the riskier the business. As a result, for early stage companies, the discount rate is meaningfully higher than for companies who are more mature. That being said, small scale does not mean immature and large scale does not mean mature.

In the model, I have broken out a few components to help gain precision on the discount rate. Again, this is meant to be directional.

(Note that in a traditional DCF analysis, discount rate is calculated as a WACC - weighted average cost of capital. Meaning it includes both cost of debt and cost of equity, which depends on a number of factors including risk free rate, market risk premium and beta (see CAPM). These numbers are nearly impossible to calculate with any precision for a startup, so we take a conservative base rate of 25% and go up from there).

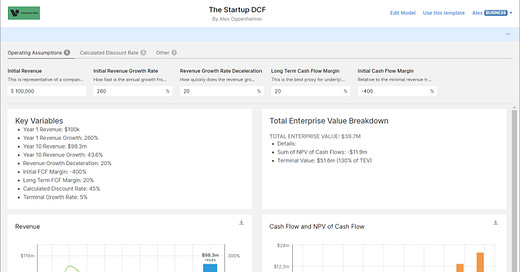

So here it is: The Startup DCF Model.

Feel free to play with it by adjusting the variables to get a feel for their impact or clone and modify it yourself. I recommend getting your Revenue and Cash Flow projections set and then adjusting discount rate and long term growth and observing how valuation changes.

https://my.causal.app/models/116210

Note: you can use ranges in Causal, i.e. you can write 3% to 5% and it will display a range of outputs accordingly.

Here is a video walking through a few different scenarios and mapping each variable to a company characteristic.

https://www.loom.com/share/29f56649c1724872bf9236c5d4323601

My hope is that this clarifies how startups are valued and removes of the mystery and seeming randomness in the market in addition to providing a quantitative framework to validate what many of us instinctively understand about what makes a startup more or less valuable.

Appendix

Let’s take two examples of nascent companies to better understand this dynamic and how I think about it on an initial pass:

Repeat founders starting an enterprise cyber security business for the third time together.

Discount Rate

Operating risk: low because they have already shown the ability to operate and scale a business successfully.

Team risk: low because they have all proved their ability to work together productively, build and hire effectively at scale.

Market risk: cybersecurity is a large and growing market that exhibits common patterns for success due to the fact that it is a preventative and reactionary business dealing with existential business threats. Though competitive, there is a clear path to success in this market.

Technology risk: the product needs to be innovative and robust to really take hold in the market, though they will most likely be able to make it happen.

Financing risk: This is where it becomes a bit circular as it depends on a number of these other factors, but ultimately gets to the question of both how much the company needs to raise to be successful, how favorable market conditions are and the ability to raise that capital all things considered. In this case, financing risk is quite low because of the aforementioned market and team dynamics along with the criticality of the solution. Their relatively low cost of capital will drive them to raise more, in theory allowing them to grow faster.

Near-term growth rate

Once this business gets going, it will be able to take off with a strong enterprise flywheel effect and clear sales playbook with the ability to hire sales leadership with relevant experience to scale quickly.

Long-term growth rate

Cybersecurity is a going to continue to outpace other sector growth meaningfully, so steady state here is likely pretty high.

Cash flow margin

Near-term, they are likely going to burn quite a bit as they try to get things going.

Long-term looks quite good with examples like Checkpoint: 49%, Crowdstrike: 31%, Palo Alto Networks: 34%, Fortinet: 33%.

Conclusion: Valuation here even from an early stage is likely going to be quite high as a number of factors are meaningfully in their favor and de-risked. In addition, even if it doesn’t become a massive platform, the likelihood of losing money is low due to the multiple exit options along the way and the clear value they offer their customers at any scale.

Social media video sharing startup with 22 year-old recent grad founders.

Discount Rate

Operating risk: quite high - this is their first time working professionally, let alone running a company.

Team risk: also quite here - even the best of friends can have issues once they become business partners. This is very hard to judge at this stage in young careers.

Market risk: it abounds - not only are consumers fickle, they also risk competition and copy-cat dynamics from bigger players, even if it works.

Technology risk: building the product itself is likely not so hard and the challenges will only come with success when supporting something at massive scale becomes a challenge.

Financing risk: for all the these reasons, the company’s ability to continue to get financed and support itself is limited. If it takes off, it will work, but any stagnation in adoption will make supporting a free product with equity financing difficult, increasing the cost of capital.

Near-term growth rate

Potentially explosive, although revenues may not come until much later.

Long-term growth rate

Given that the market here could be the entire internet-connected world, g could be fairly high. That being said, maintaining pricing power to drive scaled revenue growth could be a challenge.

Cash flow margin

Near-term the company is going to consume cash to build an engaged user base before any monetization.

Long-term we can look at names like Google: 24%, Facebook: 11%, Snap: 0%, Twitter: 3%, Pinterest: 10%, to get an idea of what kind of margins a business like this can achieve at scale.

Conclusion: An investment may make sense here at a low valuation unless there is a particularly strong angle on market and execution that can de-risk the founders and their strategy. If it works it can be huge, but the likelihood of success is low and the capital needs are large.