You pick the Valuation, I set the Terms…

This is an old adage in the world of venture investing that represents the potentially massive disconnect between the “valuation” on the…

This is an old adage in the world of venture investing that represents the potentially massive disconnect between the “valuation” on the term sheet and the returns in various exit scenarios. I put “valuation” in quotes because of this disconnect. How often do we read “XYZ company has achieved a $1Bn valuation” or “ABC company is now worth $2Bn” or something of the like? The problem with these statements is that, even though financiers understand that we are using the term “valuation” as shorthand, the continued use of the term has muddled its meaning for the general public. The term “valuation” is what someone is willing to pay for asset — generally the whole asset (when a share of publicly traded stock is sold, it instantly implies a valuation of the entire business because of the liquidity and parity in the outstanding shares). The problem is that when a company raises $50M of primary capital and sells 10% of the business, the new investor is really only implying that the 10% they bought is worth $50M and not that the entire business is necessarily worth $500M. Obviously we can do the math: $50M / 10% = $500M to get the implied valuation. The problem is that the mathematical implication can be very different from the fundamental definition of valuation of the entire asset. If that investor really thought the business was worth $500M, then they would buy the entire business for $500M. Investing $50M for 10% implies just that: 10% of the company is worth $50M. What is the rest of the company worth? It depends. (Arguably this view of partial valuation is increasingly relevant as larger investors outside traditional VCs begin to play in the venture investing market. If, for example, a large leveraged buyout fund wanted to buy an entire business, they could and they would — therefore they are making a clear statement when they pay $X for Y% instead of buying the business outright).

This is right about where liquidation preferences come into play. The first point that needs to be made regarding liquidation preferences is that they are very standard and, I believe, align incentives between founders, employees and investors. Liquidation preferences are not some greedy or vindictive way for investors to punish entrepreneurs, employees or early investors. One way to look at liquidation preference for preferred shares vs. the lack thereof for common shares is to understand the ingredients that go into building a successful company: blood, sweat, tears and capital. The blood, sweat and tears are contributed by the entrepreneurs and the employees; the capital comes from the investors. Along the journey, the employees are paid with capital provided by the investors and by any operating profit. If you take a step back and recognize that the capital invested is used to pay salaries, then the basic liquidation preference starts to make more sense: the employees have a guaranteed return built in through their salary, so why should the investors not lock in some sort of return (or really refund) as well? (This is more philosophical discussion about who deserves what and when, maybe for a later blog post). The question of how to make this fair and equal is not simple, but the de facto method in most deals today is a 1x non-participating liquidation preference. I won’t pretend to be unbiased, but I think this is straightforward and fair.

So why all the negative press about liquidation preferences? (A few examples here, here and here.) I believe it is because in the mega financings of the last couple of years terms have morphed from the basic 1x non-participating preferred mentioned above into something much more complicated. I think there are a couple key reasons for this shift towards “creative terms” in venture deals. The first is the amount of capital being poured into highly risky investments in relatively nascent companies and markets. This type of investing is riskier that smaller scale investing (i.e. early stage, lower burn) or lower risk investing (i.e. EBITDA-positive growth equity), and it is supported by the thesis that venture-backed winners are massive, so capital chases the breakout companies. (I have constantly asked myself why there isn’t more secondary investor-to-investor trades between funds with different return profiles and the only answer I have come up with so far is “human psychology.” Secondary investments by definition do not increase liquidation preferences but allow new investors to invest non-dilutive capital into businesses they like analogous to the stock market.) The second key reason is the influx of “non-traditional capital” into venture-backed companies. This generally includes mutual funds, buyout funds, hedge funds, sovereign wealth funds and family offices. These investors all have different risk-reward appetites and returns goals and, due to a number of macro economic factors, have looked outside their traditional investment areas for better returns. When different asset class investors cross over, there will be a disconnect in expectations for returns and appetite for risk, and in the venture-backed asset class this appears to have been worked out, at least in part, with more complicated financing terms. The expectations of and reporting to limited partners (LPs) in these funds is different from the way it is done in venture capital, which is a key driver behind some of these notorious terms. As an example: if a diversified asset manager has a 2x liquidation preference on a venture-backed deal, they can report to their LPs that they have a guaranteed 2x return over some expected investment period (which can also be set in the terms), implying a specific IRR. This is highly problematic because it is not aligned with the way most venture-backed companies develop and ultimately achieve liquidity. In the world of leveraged buyouts, for example, this idea of a guaranteed return is possible because the businesses are throwing off cash and unless something goes catastrophically wrong, they will continue to do so and pay off debt, which is accretive to the PE fund that owns the asset and represents a predictable return. There are a number of factors that go into every deal and motivate each investor and it’s difficult to parse it out on a theoretical level. I recognize that this can be a bit hard to follow on a theoretical level, so I have drawn up a representative example that hopefully illustrates how it might play out.

Below is an example of a very simple startup fundraising schedule.

The key takeaways here are:

The company is crushing it. The share price went up 4x between the Series A and Series B and then over 7x between the Series B and Series C. This is aggressive but not unheard of.

The standard liquidation preferences on the Series A and B are followed up by an aggressive 3x liquidation preference in the Series C.

Note that a 3x liquidation preference in a strong company is rare, but I used it here to represent a number of other mechanisms that can get embedded into term sheets which can ultimately have the same basic effect. They include: IPO ratchets, participating preferred, blocking rights, dividends, set exit dates and guaranteed returns. Be on the lookout for these terms in any term sheet.

To understand how this might play out in various exit scenarios, I built the charts below. The first shows absolute return in dollars and the second shows percent of total return by share class. The labels for each series include the percentage share ownership for each series, respectively.

Key takeaways here:

The stuff going on below $500M exit valuation is indiscernible besides the Series C being high and all others being low (I will zoom in on it).

The return for the Series C is flat until the $3Bn exit valuation mark where it starts to increase like A, B and Common. This is because it’s where Series C will elect to convert to common. At any valuation lower than $3Bn, Series C holders (who own 10% of shares) would exercise their liquidation preference (worth $300M) instead of converting to common. If, for example, the company went public below $3Bn and all shares collapsed into one common class, the Series C holders could either block the deal or require that they be compensated with additional shares to lock in their 3x return (depending on the specific terms).

Another representation is below, now based on percentage returns.

The key takeaways here:

Things are funky in the ~$300M valuation range (will zoom in on this as well).

The lines converge to their basic share ownership percentages at around $3Bn, but are skewed at lower values.

Now zooming in:

Key takeaways:

In the sub-$400M exit range, things are pretty stark: nobody besides the Series C gets a dime until $300M valuation is crossed.

The next most senior preference belongs to Series B, who invested $25M at a 1x preference. They get all additional proceeds between $300M and $325M.

Next is Series A who invested $5M at a 1x preference. They get additional proceeds between $325M and $330M.

At $330M, the common shareholders start to get a return.

As we saw before, the preferred shareholders stay on this linear return trajectory (with Series C staying flat) until $3Bn. Remember that Common owns 58% of the shares, Series A 14%, Series B 18% and Series C 10%, but this has almost no bearing on returns at lower exit valuations.

Now on a percentage basis:

The delta between percentage of returned capital and percentage of share ownership is big — even at a $1Bn exit valuation. But remember, the post-money valuation on the Series C was $1Bn. This is where things get complicated and this is the reason I don’t like when people do the implied valuation math at the investment stage (especially without knowing the terms). It’s clear that not every percentage point of the company is worth the same amount, rather it depends on the terms and on the exit valuation.

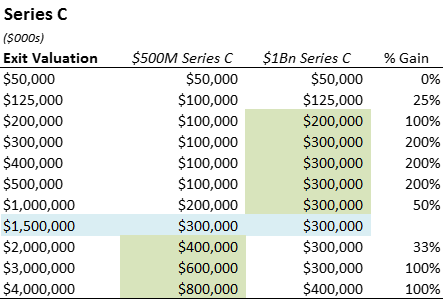

This complexity is due to the 3x liquidation preference on the Series C, which was at a $1Bn post-money valuation. If instead the company raised $100M Series C at a $500M post-money valuation with a 1x liquidation preference, the financing would look like:

The key takeaways:

Now the Series C owns 20% (vs. 10% in the previous example), which means more dilution for other shareholders.

Common now owns 51% instead of 58% in the previous example. Series B owns 16% instead of 18% and Series A owns 13% instead of 14%.

There is a total of $130M of liquidation preference, which is equal to the paid in capital into the business (vs. $330M in the previous case).

The step up in share price between Series B and C is 3.2x.

The company no longer gets to be called a unicorn :(

A note on unicorns: this is the original article, and it talks about 39 unicorns of which 14 were still private. Oh how the times have changed.

But let’s look at how the returns play out:

And on a percentage basis:

The major takeaway is that the dollar returns become linear at much lower valuations and that the percentage returns converge with the percentage ownership at a much lower valuation.

And zooming in:

The takeaways:

At $500M exit valuation, all parties are getting a return proportional to their share ownership (which makes sense given the $500M post-money valuation), but even at $300M, things are not so far off.

Series B starts getting a return above a $100M valuation, Series A above $125M and Common above $130M valuation. Note that his company raised $130M — that’s a lot.

I like charts — I think that’s pretty clear by this point. But I think they’re necessary to understand the return dynamics with an aggressive liquidation preference at a higher valuation vs. a more vanilla set of terms at a lower valuation.

An additional important note here is that I have used a simple non-participating senior liquidation preference for each round and simply upped it to a 3x in the Series C. There are many terms that can create this return dynamic including IPO ratchets, participating preferred, blocking rights, dividends, guaranteed returns and exit dates, but I think that this simple example provides a high level understanding of how these will ultimately play out: the investor with the preference gets a disproportionate return directly or through a term negotiation on the back end. While it is unlikely to see a 3x liquidation preference in a financing of a fast growing company, it is not unlikely to see some combination of the terms mentioned above that could ultimately have the same effect.

Let’s compare a few different exit valuation scenarios for the two financing scenarios modeled above.

Scenario 1: $100M Series C at a $900M Pre-Money valuation with a 3x Senior Liquidation Preference

Scenario 2: $100M Series C at a $400M Pre-Money valuation with a 1x Senior Liquidation Preference

Looking at the common return between the two financing scenarios:

By choosing the deal at a $1Bn valuation (with 3x liq pref), the common shareholders have decreased their relative return in all exit scenarios below $1.5Bn — sometimes meaningfully (i.e. at a $300M valuation, where a founder might take home $0 instead of $32M in the $500M 1x scenario).

Assuming that boards and founders do the math above before they step into a deal (which we can unfortunately not assume), it leads to only one conclusion about the decision driver: irrational greed. In a case where the company sells for $300M, a founder could make $32M instead of $0, and in the case where the company sells for or IPOs at $3Bn, the founder makes $384M instead of $432M (in the $500M and $1Bn Series C financing scenarios, respectively). You have to be very confident (and pretty greedy) to knowingly make that tradeoff.

Looking at the same table for the Series C investors the issue becomes clear.

Whereas the common shareholders (and the Series A and B investors in this case) do better in the $500M scenario up to $1.5Bn exit valuation, the Series C investors do the better in the $1Bn 3x liq pref scenario up to $1.5Bn. And in fact the Series C investors get the exact same return whether the company sells for $300M or $3Bn in the $1Bn 3x liq pref scenario. This creates very different incentives for common & early investors than for the Series C investors. The Series C investor is not interested in a ~$1Bn sale and will push the company to try to achieve a valuation greater than $3Bn because anything less than that is not marginally interesting to them. (Additionally, if it becomes clear that an exit above $3Bn is highly unlikely, the Series C investor has no motivation to help the company achieve anything above a $300M exit.) The issue is that a $1Bn sale is an AMAZING outcome for a startup company. The other issue is that every company cannot be worth more than $3Bn. In fact only a handful of companies have actually achieved liquidity in this stratosphere over the last few years.

Anyone who has spent time in the venture ecosystem knows how hard it is to create value in a startup. The process of starting with an idea and developing and executing an operation is unbelievably challenging. As an investor, I feel lucky to be along for the ride but continually laud entrepreneurs for their vision, drive and idealism. In order to even have a shot at achieving big success, entrepreneurs, employees and investors need to be aligned and have the same goals in mind. There are many outside variables for every startup— market risk, competition, technology risk, regulatory risk — and each one can disrupt a company’s trajectory. Introducing the additional risks associated with misaligned incentives related to financing is effectively making a hard job even harder.

I don’t think enough people are doing the detailed calculations and instead have been enchanted by headline valuations, which not only have little to no bearing on long term success, but can actually hinder success in many scenarios. I am happy to share the model behind the calculations above, and I encourage all shareholders to do the math to make sure that any new investor will be aligned with the broader shareholder group in realistic exit scenarios.